Understanding Risk Management in Investing

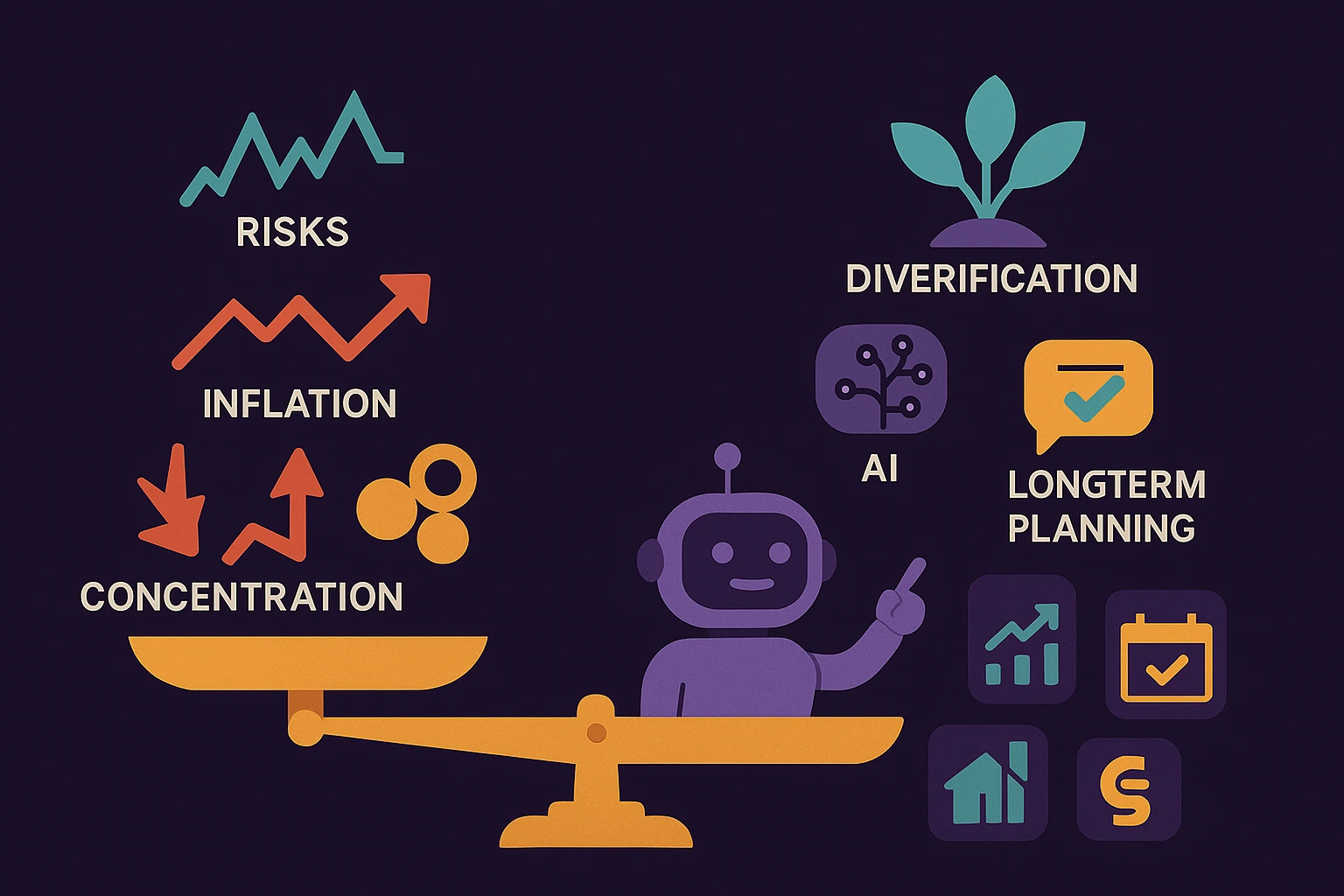

Every investment comes with some level of risk - but managing that risk is what separates smart investors from lucky ones. In this guide, you'll learn how to assess, control, and make peace with risk based on your goals and time horizon.

What Is Risk in Investing?

Risk is the chance that an investment will perform differently than expected - including the possibility of losing money. It's not something to avoid, but something to understand and manage with intent. Using a personalized AI financial advisor can help clarify which risks apply to your profile.

Common Types of Investment Risk

- Market Risk: The risk of your investments losing value due to overall market downturns.

Example: Stocks falling during a recession or global crisis. - Volatility Risk: How sharply an investment's price fluctuates over time.

Example: Tech stocks with large price swings in a single week. - Liquidity Risk: Difficulty selling an asset quickly without a major price cut.

Example: Selling real estate during a housing slump. - Inflation Risk: Losing purchasing power if returns don't outpace inflation.

Example: Holding cash or low-interest savings when inflation is high. - Concentration Risk: Having too much of your portfolio in one asset or sector.

Example: Investing only in tech companies like Apple, Google, and Microsoft.

How to Manage Investment Risk

- Diversify: Spread your investments across different asset classes and industries.

Example: Combining stocks, bonds, real estate, and international funds. Learn more on diversification. - Know your time horizon: Longer time frames can absorb more short-term risk.

Example: A 25-year-old saving for retirement can take on more equity exposure than someone retiring in 3 years. Learn more about time horizon planning. - Match risk to your goals: Align your strategy with what you're investing for - retirement, a home, or passive income.

Example: A conservative bond-heavy portfolio for a short-term goal like a home purchase. - Review and rebalance: Periodically adjust your portfolio to stay within your comfort zone.

Example: If stocks outperform and grow to 80% of your portfolio, selling some to restore balance. See asset allocation for context. - Use Investron's AI: Our assistant helps identify risky concentrations or surface alternative options based on your preferences.

Example: Spotting overexposure to tech stocks or suggesting ETFs to reduce volatility - powered by our AI assistant.

Remember:

The goal isn't to eliminate risk - it's to take the right amount of it for your situation. The more you understand it, the better decisions you'll make. Tools like a smart portfolio tracker and AI recommendations can help guide you.