Understanding Market Cycles

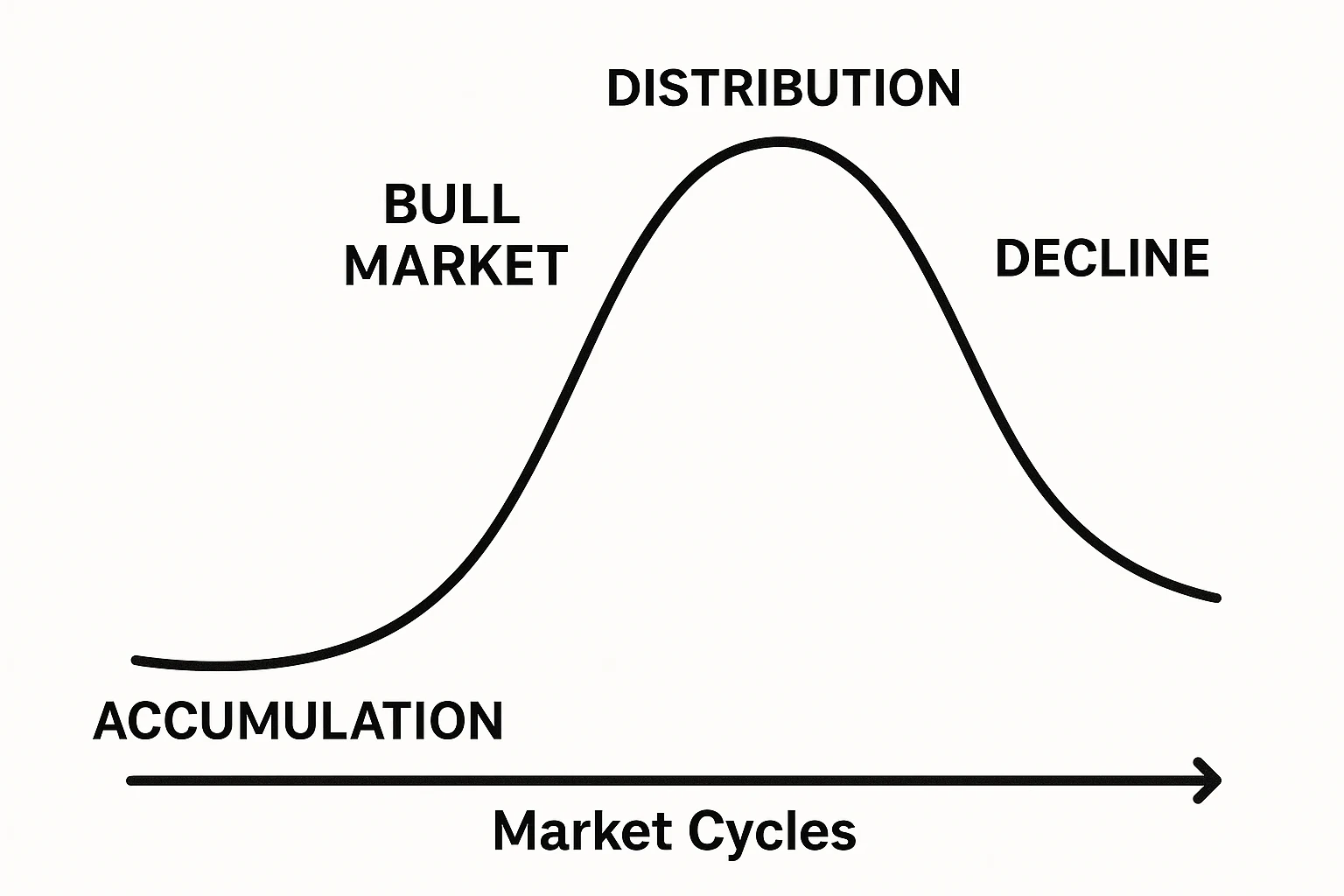

Markets don't move in straight lines. They rise, fall, recover, and repeat - often in recognizable phases. Understanding market cycles helps investors make informed decisions, manage emotions, and stay committed to long-term goals.

What Are Market Cycles?

A market cycle is the natural rise and fall of market prices over time. While the exact length and triggers can vary, most cycles follow a pattern of growth, peak, decline, and recovery. These movements are shaped by investor sentiment, economic data, interest rates, inflation, and global events. Investron's AI assistant can help you identify which phase the market may be entering by surfacing the latest trends and expert insights.

The Four Common Phases

1. Accumulation

The market has bottomed out, pessimism is high, but smart money begins buying undervalued assets. Prices are stable or slowly rising. A great time to revisit your investment strategy.

Examples: Broad market index funds, blue-chip stocks, undervalued sectors like industrials or financials, and high-quality bonds.

2. Uptrend (Bull Market)

Optimism grows, earnings improve, and prices increase steadily. Retail investors join in. This is typically the longest and most profitable phase, ideal for long-term investors focused on compounding returns.

Examples: Growth stocks, sector ETFs (e.g., technology or healthcare), real estate investment trusts (REITs), and international equities.

3. Distribution

The market reaches a peak. Valuations are high, growth slows, and early investors start selling. Volatility increases and sentiment becomes mixed.

Examples: Rotate into defensive stocks (e.g., utilities, consumer staples), increase cash holdings, or consider taking profits on overperforming assets.

4. Decline (Bear Market)

Fear dominates. Prices fall sharply, often triggered by economic downturns or crises. Eventually, the cycle resets as value re-emerges. Investron can help surface defensive assets or personalized diversification ideas to navigate downturns.

Examples: Defensive stocks, precious metals (like gold), high-grade bonds, and dollar-cost averaging into broad-market ETFs.

Why It Matters

Market cycles affect everything from stock valuations to investor psychology. Knowing which phase you're in can help you:

- Stay calm during downturns

- Recognize opportunities during recoveries

- Avoid chasing overvalued assets at peaks

- Stick to your long-term investment strategy with confidence