Understanding Compound Interest

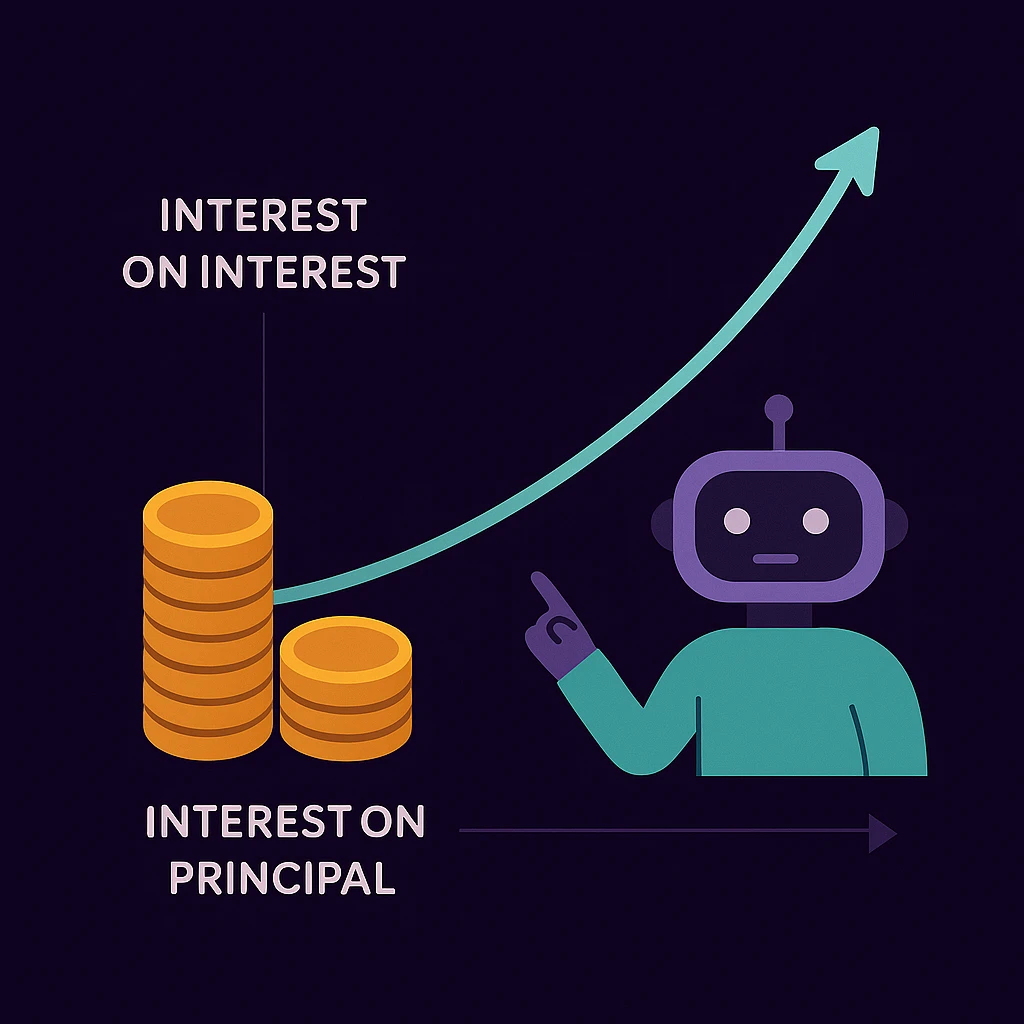

Compound interest is the principle of earning interest not only on your initial investment, but also on the interest that accumulates over time. It's one of the most powerful forces in long-term investment strategies and wealth building.

How Does Compound Interest Work?

When you invest money, you typically earn interest (or returns) over time. With compounding, those returns are reinvested - meaning you start earning "interest on your interest." Over time, this leads to exponential growth, especially when tracked in an investment portfolio app.

The longer you stay invested, the more powerful compounding becomes. Even small, consistent contributions can grow significantly if left to compound over many years. An AI financial advisor can help you find the best reinvestment opportunities and educational resources tailored to your goals.

Example: The Power of Time

If you invest $1,000 at a 7% annual return:

- After 1 year: $1,070

- After 5 years: $1,403

- After 10 years: $1,967

- After 25 years: $5,427

Notice how the growth accelerates over time - that's compounding in action. Starting early can make a huge difference, even if the amount is small.

Compound interest calculator:

What Affects Compound Growth?

- Time: The longer your money compounds, the more powerful the effect. Time horizon matters.

- Rate of Return: Higher returns lead to faster growth (though often with higher risk). Learn more about risk management.

- Contributions: Regular investments accelerate compounding. Your AI investing assistant can help you discover high-potential opportunities for consistent investing.

- Reinvestment: Reinvesting dividends and interest boosts compounding - and your AI assistant can suggest where and how to do it effectively.