What Is Asset Allocation?

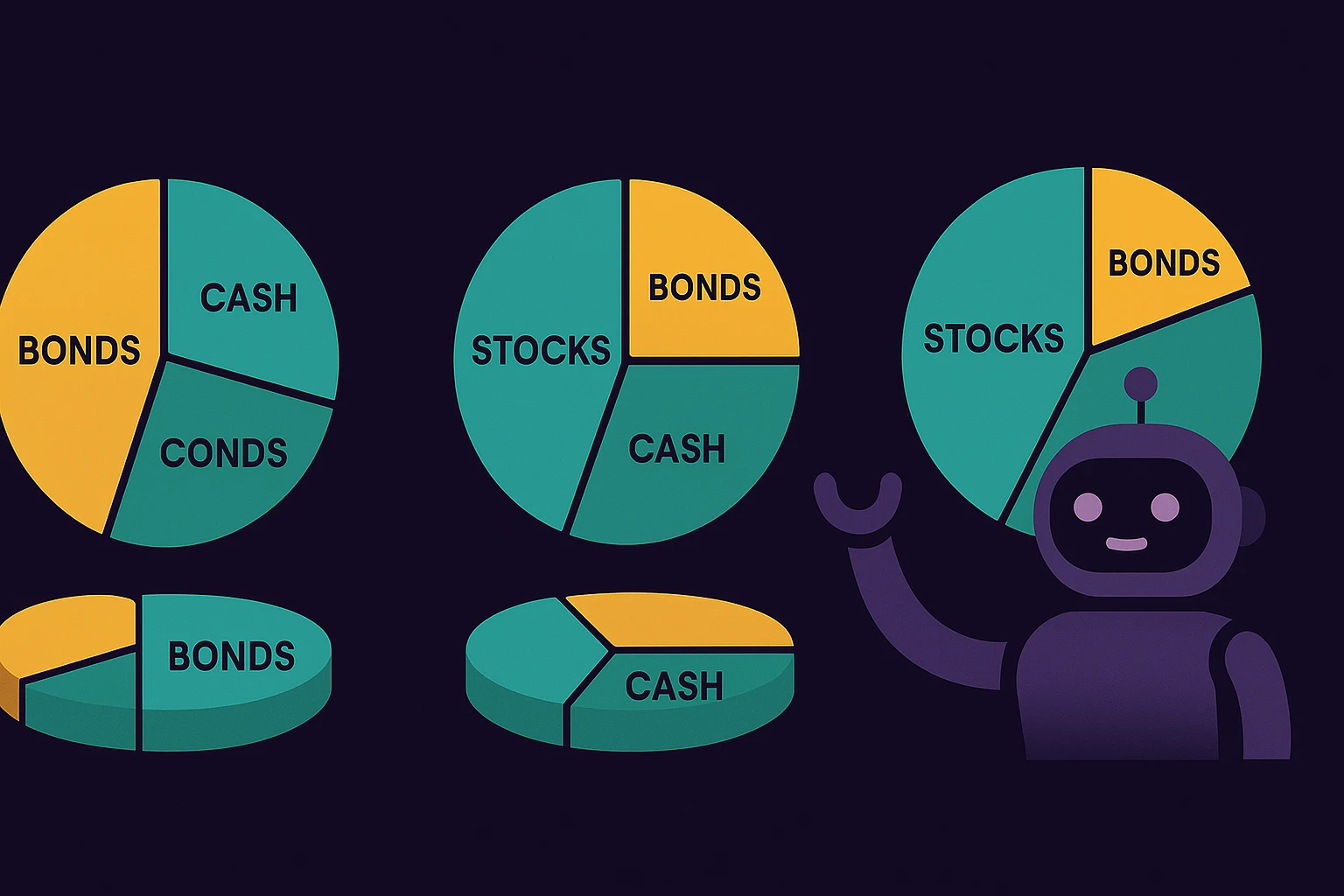

Asset allocation is the process of dividing your investments among different asset classes - such as stocks, bonds, and cash - to balance risk and return according to your financial goals and risk tolerance.

Why Asset Allocation Matters

Different assets perform differently depending on the economic environment. Market cycles influence how investments behave - stocks may thrive during growth, bonds during downturns. Asset allocation helps protect your investment portfolio by ensuring you're not overexposed to any single investment type.

Example Allocations

- Conservative: 20% stocks, 70% bonds, 10% cash

- Balanced: 50% stocks, 40% bonds, 10% cash

- Aggressive: 80% stocks, 15% bonds, 5% cash

Your ideal mix depends on factors like your time horizon, income needs, investment experience, and risk tolerance. Using an AI financial advisor can help you personalize your allocation based on real-time data.

Pros and Cons of Asset Allocation

Pros

- Spreads out risk across multiple asset types

- Reduces volatility over the long term

- Can be tailored to your investment strategy

- Helps you stay invested through market changes

Cons

- Requires rebalancing over time (which your AI investing assistant can automate)

- May underperform concentrated strategies in bull markets

- Not a guarantee against losses in major downturns

Who Should Use Asset Allocation?

Asset allocation is essential for all types of investors - from beginners using a portfolio app to experienced traders seeking stability. Whether you're building wealth, preserving it, or generating income, allocation helps align your approach with your goals and risk level. You can also discover the best strategy for you using our personalized recommendation tool.